Who finished the song lyric in their heads? (Ralph??) Lol!!

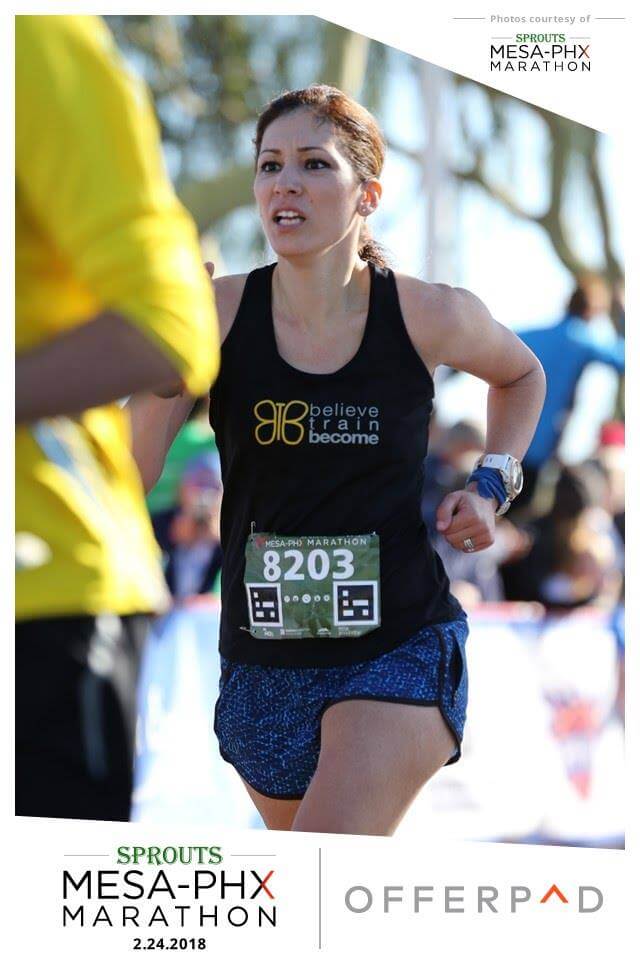

Anyway, I’m back as in back to the blog-o-sphere and back to running, but let me tell you, I am not back as in “running shape”.

Back to writing— In this point of my running life, I’m in a vulnerable state. I’m the heaviest weight wise I’ve ever been not pregnant and the most out of shape I’ve ever been since I’ve started running.

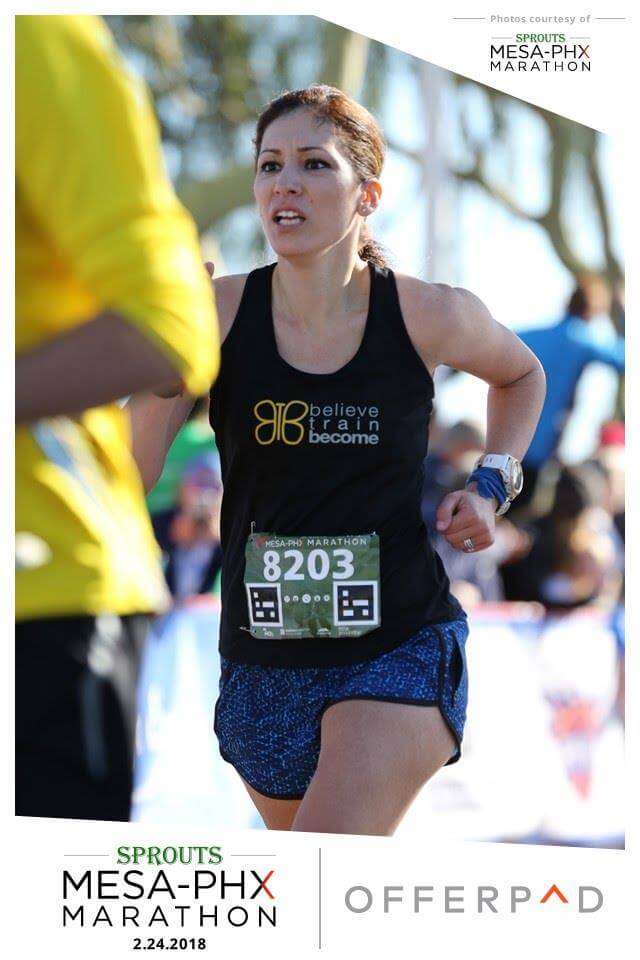

Back to running— The itch to get back into the running game is strong, the goal running game, that is. The I-Feel-Like-I-Want-To-Die-While-Training running.

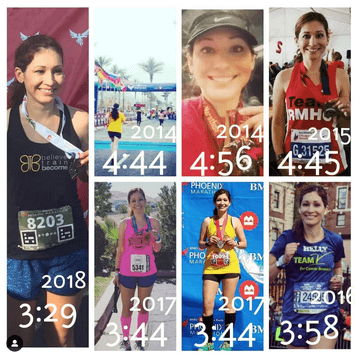

On a serious note though, I’ve always loved reading about real people and their journeys. It’s what motivated me to start running in the first place–I NEVER thought I would qualify and run Boston Marathon. But I’ve seen what I can do when I put mind to it, test my limits, and become comfortable with uncomfortable.

–Do you sometimes feel defeated before you even start training? How do you get out of your head?

–Do you keep goals attainable? Just hard enough but still realistic? Or do you go big or go home?